- Home

- Maintaining Independence and Safety in the Home

- Addressing Ageism and Promoting Positive Attitudes Towards Aging

- Estate Planning: A Simple Guide for Seniors

- Rediscovering Your Inner Innovator: Thinking Outside the Box

- How Seniors Might Celebrate Milestones

- Cherishing Our Seniors: 6 Ways to Show You Care

- Nourishing the Golden Years: 5 Dietary Considerations for Seniors

- The Importance of Preventive Care and Regular Check-ups for Seniors

- Adapting to Change

- Feeling Lost in a Sea of Doctors and Deductibles

- Live Your Best Life: Easy Exercises for a Healthier, Happier You

- God's Gifts in the Digital Age: Technology Enriching the Golden Years

- Living Well with Arthritis: A Guide to Natural Approaches

- Helping Seniors Combat Loneliness and Thrive

- A Senior’s Guide to Weight Loss

- Ready for Your Next Chapter? A Friendly Guide to Retirement Planning

- Embrace Aging with Delicious Food: Your Guide to an Anti-Aging Diet

- BMI and Seniors: Understanding the Numbers for a Healthier You

- Finding Freedom from Regret: A Christian Perspective for Seniors

- How Seniors Benefit from Drinking Water

- Finding Peace and Contentment in Knowing Jesus: A Guide for Seniors

- 5 Ways for Seniors to Make Meaningful Connections

- Finding Freedom from Guilt

- How Seniors Can Help When Disasters Occur

- A Senior's Guide to a Mindful Morning Routine

- Strength Training for Seniors

- The Inspirational Journey of Colonel Sanders"

- Boosting Vitality and Longevity for Seniors

- Boosting Senior Health: A Guide to Antioxidant-Rich Foods

- Engaging Ways for Seniors to Foster Intellectual Growth

- A Biography

- Strategic Estate Planning for Family Harmony

- Navigating the Challenges of Aging with Grace and Humor

- Decoding the Nostalgic Humor in Senior Citizen Phrases

- Senior Driving: When to Hit the Brakes

- Seniors: Guiding the Younger Generation

- Medications & Herbs: A Risky Recipe

- Preserving Your Legacy

- Balancing Act

- Seniors Need Rest Too

- Helping Someone Survive an Emergency

- The Pros and Cons of Perseverance

- You Can Experience Joy

- Dealing with Difficult Emotions

- The Best Time to Retire

- How to Declutter Your Home

- Benefits of Adequate Sleep

- Encouraging an Adult Child

- Maintain and Improve Your Brain Power

- How to Deal with Embarrassment

- When You’re Beyond the End of Your Rope

- Help a Struggling Friend

- Taking Care of Yourself

- Improve Your Concentration and Focus

- How the Web Impacts Your Life

- Your Personal Power

- On Building and Maintaining Relationships

- A Picture of God

- Becoming More Adaptable and Resilient

- Making the Best of Bad Situations

- The Surprising Benefits of Intermittent Fasting

- Cultivate an Attitude of Gratitude

- Repair a Relationship

- AVOID CAREGIVER BURNOUT

- Top Tips for Keeping a Sharp Mind

- Succeed in Social Gatherings

- Benefit Society Even in Retirement

- Surviving Winter

- From the Depths of my Scatter-Brained Mind

- The Story of Joseph

- Parenting is Not for the Faint-hearted

- Keeping Passion in Your Marriage

- The Bible’s Influence on History

- Surviving the Loss of Your Spouse

- Purposeful Traveling

- Senior Money Management

- When Life Goes South

- Retire Well

- Using Smartphones and Tablet

- How to Choose an Assisted Living Community

- Giving and Getting Help

- Avoid Being Scammed

- Senior Safety Source

- Technology Can Benefit Seniors

- Why Do We Dream

- Your Mental Ability

- What Is Cold Water Therapy?

- Plan a Road Trip

- Comparing Sweeteners

- Improve Your Communication Skills

- Being Comfortable in Social Gatherings

- Store-Bought vs Home-Grown Food

- Surviving Tough Times

- What About Social Media?

- What About Intermittent Fasting?

- Combat Mental Fatigue

- Be Alone and Don’t Feel Lonely

- Building and Maintaining Relationships as We Age

- Being True to Yourself and Others

- Remaining Generous in a Difficult Economy

- How To Stay Awake After A Poor Night’s Sleep

- Stay Warm in the Winter

- Dealing With Insufficient Retirement

- Seniors Can Avoid Fraud

- An Attitude of Gratitude

- Ways to Make Your Friend Feel Appreciated

- 9 Ways Tackling Clutter Can Enhance Your Wellbeing

- Biofeedback: Is It Right For You?

- A Biblical Admonition

- Debunking 5 Myths About Caregivers

- Fun Activities for Your Elderly Parents

- Considered Getting a Pet?

- The Art of Grandparenting

- Seniors Aging Gracefully

- Travel Destinations in the Continental U.S.

- Micro Exercises for Senirs

- The Great Sport of Pickleball

- Helping Someone with Alzheimer's

- The Positive Side of Adult ADHD

- Still Fresh, Ancient Wisdom

- Dealing with Memory Issues

- Considerations for a Retirement Home

- Know About Panic Attacks

- Improving Sleep

- 4 Comforting to Help You Cope with Grief

- Exercise Safely with Back Pain

- Food Allergies And Intolerances

- Loneliness and Your Health

- What Jaws Can Teach You About Overcoming Fear

- Simple Tricks to Beat Brain Fog

- How Focus Can Change Your Life

- 5 Ways To Build Your Resilience

- Overhaul Your Diet In Six Simple Steps

- Handling Social Anxiety: Three Life Hacks

- What Do You Do When Times Get Tough?

- A Foolproof Formula for Finding Peace During Uncertain Times

- What Will You Do if Your Family and Friends Seem Unsupportive?

- How to Help Elderly Parents Deal With Depression and Anxiety

- What You Need To Do To Have A Fulfilling Retirement

- How To Hire the Best Elderly Care Provider

- What Is Oxidative Stress And Why Is It Bad?

- Four Ways To Incorporate Movement Into Everyday Life

- How To Get Started With Decluttering

- How To Control Issues With Emotional Eating

- 5 Ways to Tackle Social Anxiety

- Symptoms Of A Gluten Intolerance

- How To Stop Worrying All The Time

- Steps To Better Self Development

- New Help for Type 2 Diabetes

- What Being Wrong Teaches You

- 5 Activities That Will Get You Out Of The House

- Conquer Social Anxiety With These 5 Tips to Increase Your Courage

- Offshore Banking for the Average Person

- Time Management: Is It Really Worth the Effort?

- Avoid Being Scammed for Your Money

- How Retirement Affects Cognitive Decline

- The Conscientious Path to Boosting Your Immune System

- New Research for Increasing Your Serotonin Levels

- Your Most Dominate IQ

- Income Options for Retirees

- Cognitive Changes in Seniors as We Age

- About Women: The Challenges Men Don’t Understand

- The Lost Art of Listening

- Playing It Safe With Artificial Sweeteners

- Expand Your Mind: Discover Public Media

- Differences Between Credit Unions and Banks

- About Outlet Malls and How You Can Save More

- What Your Kids Can Teach You About Self-Care

- 5 Cruel Truths That You Need to Know

- Know This About Your Pharmacist

- Silent Heart Attacks and You

- Caffeine Use Disorder

- Living with COPD

- What You Need to Know About Keeping Your Joints Safe and Healthy

- 3 Little Known Truths to Help You Plow Through Tough Times

- Every Credit Card Owner Should Know These Things

- Our Jaunt to the Mainland

- How Seniors Can Navigate Downsizing

- Adventures in Paradise

- “To Age” or “To Mature”

- Retire on a Budget

- 12 FUN RECREATIONAL ACTIVITIES FOR SENIORS

- Life of a Senior Country Hick

- Life is a Routine

- Growing Up Not a Job for Kids

- Who's in Your Corner?

- How to be More Open and Share Your Feelings

- 6 Ways to Strengthen Your Bones as You Age

- Perceived Abuse?

- Getting to Know Him

- Taking a Sensible Approach to Selflessness

- Tips and Tricks for Longevity

- Following God's Plan to Crush Your Goals

- How to Use the Internet to Find Low-Cost Hotel Rates

- Your God of Christmas

- What You Need to Know about Sugar and Your Immune System

- The Benefits of Meditation and Prayer in Everyday Life

- Common Problems Caregivers Face When Working With Seniors

- 8 Ways to Reduce Your Gas Expense

- 7 Ideas to Help You Care Less About What Everyone Thinks

- Tis the Season for Loneliness?

- 13 Simple Ways to Increase Your Energy and Mobility

- Feel Better by Leaving the Burden of Guilt Behind

- How to Overcome Frustration and Disappointment

- The 3 Most Effective Leisure Activities for Preventing Dementia

- Self-Education Habits That Enable You to Teach Yourself Anything

- How Practicing Generosity Helps You Find Happiness

- Surprising Facts about Smoking and Your Mental Health

- Learning How to Become a Good Storyteller

- 7 Low-Carb Hacks to Help You Feel Full All Day

- Tips to Increase Your Energy When You Feel Worn Out

- What Can a Gluten-Free Diet Do For You

- What You Can Do

- How to Eat Healthy During the Holidays

- Finding Peace

- Surprising News about Serotonin and Depression

- Dealing with the Death of a Loved One

- Feeling Lonely?

- Are You a Victim

- The Importance of Looking to the Future

- 5 Ways to Feel Gratitude

- How to Keep Going

- Top 10 Life Secrets

- Long Road Trip 3

- Senior Road Trip 2

- Senior Road Trip 1

- Seniors Make Each Day Count

- 9 Ways to Push Beyond Fear

- Heal Your Broken Heart

- Laugh Your Way to Good Health

- Get a Handle on Your Debt

- Read This Before You Have Laser Eye Surgery

- Learning How to Overcome Failure

- How to Connect with Others

- Dont Get a Prepaid Card

- See How Easily You Can Make

- Time Management vs Energy Management

- Say Goodbye to Daytime Drowsiness

- Top 5 Costs Retirees Often Fail to Foresee

- 5 Dirty Tricks Credit Card Companies Like to Play

- Understanding the Federal Reserve

- Interesting Seniors Memories - 1

- How the Top 1 percent Think

- Stop Seeking Approval from Others

- Beware of Energy Drinks

- 9 Strategies to Boost Your Energy

- Life Long Learning Budget

- A Love Letter

- Don't Believe Everything

- Lying to Yourself

- Stop Procrastinating

- Quit Smoking

- Human Relationships

- Sugar and Salt

- Develop Healthy Habits

- Super Senior Centenarians

- loneliness

- Importance of Mindfulness

- Strengthen Your Health

- Grumpy Old People

- Budget Friendly Travel

- Ways to Relax

- Becoming a Senior Entrepreneur

- Good to Lose Interest

- Seniors and Applesauce

- Eat Healthy food

- Gratitude Improves Health

- 17 Tips to Lose

- Benefits of Relaxing in a Sauna

- Letting Go of Anger

- An Aging Metabolism

- Aging Well

- About Managing Pain

- Age Gracefully

- Land a Better Fare

- aging grandparents

- Aging Affects Mood

- 10 Ways to Manage Frustration

- 9 Things Emotionally Healthy People Do

- Keep Your Mind Young and Healthy

- Challenges Long Distance Caregiving

- Handle Interference Technology

- About the Farm

- Save Money Travel

- Speed Up Your Metabolism

- Eat Healthier on a Tight Budget

- walking for weight loss

- Essential Senior Superfoods

- Secrets from Seniors on Finding Lasting Love

- Senior's Guide Nutrition

- Senior Guide Strong Hands

- 7 Tips to Maximize Retirement

- Problems Can Sneak Up on Seniors

- GentryBnB

- college prep tips

- What Baby Boomers Should Know

- 15 Healthy Ways to Comfor Yourself

- Senior Online Dating

- Seniors Approaching Birthday

- How to Introduce Your Adult Children to Your Significant Other

- Guide to Healthy Skin

- How to Thrive

- Find Relief from Snoring

- What About Macular Degeneration?

- Vegetarian Path to Healthy Aging

- Dietary Fiber

- Develop Your Creativity

- Need for Validation

- Overcoming Frailty

- Senior Shakeups

- Senior Medication Management

- Quality Senior Sleep

- Empty Nest Syndrome

- Seniors Travel "Locally"

- Senior Travels

- Benefits of Naturopathy

- A Senior's Guide

- Medication Safety Tips

- Losing Weight After 40

- Limited Resources

- Enjoy a Day

- Benefits of Juice Fasting

- Be More Creative

- An Essential Nutrient: Water

- Exercising Strategies to Increase Your Energy

- Ease Chronic Pain

- Cultivate Positive Behavior in Your Teenagers

- lose weight on a plant diet

- Seniors Winter Hawaii

- Love Yourself

- Ways to Bury the Pain From Your Past

- Lower Your Medical Bills

- Working Through Difficult Emotions

- Lessons from Seniors

- Strengthen Your Heart Health

- Counsel for Seniors

- Banish Self Destructive Thoughts

- Why Adult Friendships are Important

- Benefits Juice Fasting

- Seniors with Hearing Loss

- Inner Balance in a Hyper-C0nnected World

- Improve Your Powers of Concentration

- Monthly Financial Survival

- Benefits of Strength Training

- Managing Family Stress

- Handle Toxic Relationship

- What is the Point of Life?

- Top 10 Steps to Enhance Your Memory

- How to Deal With Loss

- 15 Ways to Stay Connected with Your Grandchildren

- Alcohol Ages You

- Coffee and Brain Health

- Surprising Truth About Weight Loss

- Health Benefits of a Vegan Diet

- strategies to help lose weight

- Talking to Strangers

- dementia

- Senior Guide

- Financial Fraud and Seniors

- Staying Brain Sharp

- Boost Our Immune System

- Benefits of Covid

- Essential Communication Skills

- Benefits of Fasting

- The Cab Driver

- Top Ten Benefits of a Daily Walk

- Helping Seniors Prevent Falls

- Thirteen Ways for Seniors to Maximize Immunity

- 10 Anti-Aging Techniques

- Flip House

- Thirteen Natural Ways to Fall Asleep Quickly

- Best Time Seniors Quit Smoking

- Memory Issues?

- A Great Experience!

- Good News!

- Immune System Powerup

- The Human Spine

- Alcohol and Our Brains

- Health Care Needs After Seventy -2

- Our Health Care Needs Beyond Seventy

- inflammation

- From a Friend

- More Benefits of Laugher

- Laughter Benefits Our Bodies

- Mountain Grandeur

- Yellowstone Here We Come!

- Memories and Special People

- Seniors Travel

- Childhood Memories

- Seasons of Life

- Influenza or Pneumonia

- Diabetes

- Respiratory Diseases

- Arthritis

- Heart Disease

- Seniors Oral Health

- Senior Balance Issues

- Senior Health Concerns

- Bouncing Back

- Becoming a Senior

- On Being Content

- Science and Evolution

- Priorities

- 13 Natural Ways to Fall Asleep Quickly

- How to Care for a Loved One Long-Distance

- When Travel Brings a Smile

- What's This About a Vegan Diet?

- GMO, Friend or Foe?

- What If?

- Rest for Seniors

- The Virus, Covid-19

- A Healthy Option?

- Eating Healthy

- Healthy Habits

- Exercise

- The China Study

- Guilt

- Stress Busters

- Is Science Suspect?

- Hope

- Politics and Religion

- When Life Ends

- Bible Biography

- A Wandering Mind

- About Me

- Privacy Policy

- Contact Me

- What's New?

From Fear to Faith:

A Simple Guide to

Organizing Your Estate

We have all lived long enough to realize that no one lives forever. A question that must logically proceed from that reality is: What will happen to the assets that I might have received during my lifetime? As Christians, we are called to be good stewards of the blessings God has given us, and that includes planning for their transfer to the people and causes we love. This guide is here to walk you through that process, step by step, with clarity and peace.

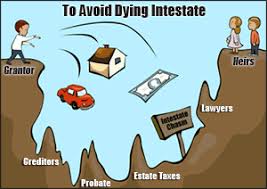

Let's first look at what happens if you do nothing. Some people call this the "do-nothing plan." The government has a plan for your estate even if you don’t. The bad news is, you probably won’t like it, and they don’t send a fruit basket for your trouble. When a person passes away without a will, it’s called dying "intestate." In this scenario, a probate court judge in your state will follow a rigid, one-size-fits-all legal formula to distribute your property.

The outcome of this court-directed process is rarely what you would have wanted. Your assets might go to a relative you haven’t spoken to in twenty years, while a dear friend or a beloved charity gets nothing. The process is public, can take months or even years, and can be expensive, with legal and court fees eating away at the inheritance you hoped to leave behind. Worst of all, it can cause painful arguments among family members who are left to guess at what your wishes might have been.

Now, let's consider the alternative: a careful, prayerful plan. This isn't about dwelling on death; it's about being a responsible steward and showing love for your family. Creating a plan is one of the most considerate gifts you can give to your loved ones. It replaces confusion with clarity, anxiety with peace, and potential arguments with a clear path forward. It ensures that your lifetime of hard work blesses the people you intend it to bless

Many people feel a sense of dread and think, "I'm afraid of dealing with this complicated topic." It’s a perfectly normal feeling. The paperwork, the legal terms, the thought of the IRS—it's enough to make anyone want to put it off. You might be asking, "I know it's important, but how can I overcome my fear?" The answer is to reframe the task. You are not preparing for an end; you are organizing a legacy of love. You can overcome this fear by taking small, simple steps, one at a time, to bring order and peace to your affairs and your family’s future.

If you struggle with paperwork and organization, let’s start with something simple and not the least bit scary. Get a sturdy three-ring binder and label it "My Important Information." That’s it! Your first step is done. This binder will become your central place for everything. Don't try to find everything in one day. This week, just find one document—maybe the deed to your house or your most recent bank statement—and put it in the binder. Each week, add one or two more things. This slow, steady approach turns an overwhelming mountain into a series of small, manageable molehills.

What should go into this binder? Think of it as a roadmap for your family. Include copies of things like: bank and investment account statements, life insurance policies, deeds to property, car titles, and a list of any valuable personal items (like jewelry or antiques) and who you’d like to have them. Also, include a list of important contacts, like your pastor, your doctor, and any financial professional you work with. Finally, make a list of your online accounts and passwords—this is a critical piece of information in our digital world.

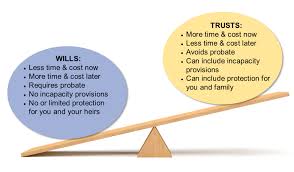

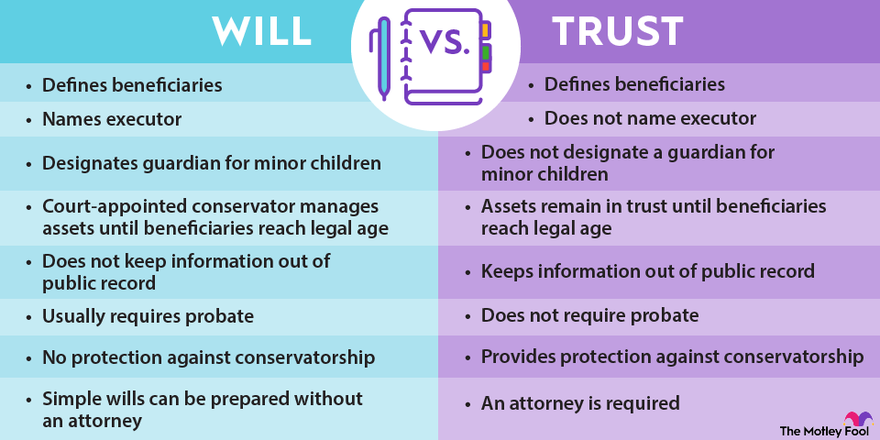

The most basic planning tool is a Last Will and Testament. A will is simply a legal document where you state who you want to receive your property and who you want to be in charge (the "executor") of carrying out your wishes. For someone with a very simple estate—for example, you own a home, a bank account, and a car, and you want to leave it all to one person—a state-specific statutory will form might seem like a simple DIY option. However, these forms can be very rigid and may not fit your specific situation.

So, how do you know when you absolutely need outside help? You should seek professional advice from an attorney if your situation includes any of the following: you have a blended family with children from a previous marriage, you want to disinherit a close relative, you have a child with special needs, you own a business, or your total assets are significant (approaching the estate tax exemption levels). In these cases, a DIY approach can lead to serious legal problems and family heartbreak down the road.

Finding the right help doesn't have to be difficult. An estate planning attorney is a lawyer who specializes in this area. They can draft the documents needed to ensure your wishes are legally binding. Ask friends for recommendations, or perhaps your pastor or a trusted leader in your church can refer you to someone in your community with a reputation for integrity and compassion. A good professional will listen patiently and explain things in a way you can understand, without pressure.

Now, let's talk about the big, scary monster in the room: the IRS. Many people are terrified that the government will take a huge chunk of their estate in taxes. Here is some wonderful, reassuring news: this is very unlikely. According to the IRS, for 2024, the federal estate tax only applies to estates valued at over $13.61 million per individual. The vast majority of Americans will never have to worry about paying any federal estate tax. Your fear of the IRS, while understandable, is likely unnecessary when it comes to your estate.

One of the most powerful and easy DIY planning steps you can take involves your retirement accounts and life insurance. For accounts like IRAs, 401(k)s, and life insurance policies, you can name a "beneficiary" directly on the account paperwork. When you pass away, the money in these accounts goes directly to the person you named, completely bypassing the long and public probate court process. It’s simple, free, and you can usually do it online or with a one-page form from your financial institution. Check your beneficiaries today!

You may have heard people talk about "trusts." A revocable living trust is another tool, like a will, but it can offer more privacy and control. Think of it as a basket you create. You put your assets (your house, your bank accounts) into the basket during your lifetime, you control the basket, and when you're gone, the person you named as your successor trustee simply distributes the contents of the basket according to your instructions. It avoids probate, but setting one up is more complex than a will and almost always requires an attorney.

Wise planning isn't just about what happens to your things after you're gone. It's also about who makes decisions for you if you become unable to make them for yourself. Two critical documents for this are a Durable Power of Attorney for Finances, which names someone to manage your money, and an Advance Healthcare Directive (or Living Will), which names someone to make medical decisions for you and outlines your wishes for end-of-life care. These are profound acts of love that protect both you and your family from making agonizing decisions during a crisis.

From a Christian perspective, this entire process is an act of faith and stewardship. The Bible tells us in Proverbs 13:22 that "A good person leaves an inheritance for their children’s children." This inheritance is more than just money; it's a legacy of faith, wisdom, and love. By organizing your affairs, you are modeling responsible stewardship of the resources God entrusted to you and smoothing the path for your family during a difficult time of grief.

What is the positive outcome of doing all this? It is the incredible gift of peace. You will have the peace of mind that comes from knowing you have done everything you can to protect your loved ones. And they will have the peace of being able to grieve your loss without the added burden of a financial and legal disaster. They will see your plan not as a document about money, but as your final "I love you."

So, let's recap your simple, fear-free action plan. First, get your binder and start slowly gathering your important documents. Second, make a simple list of what you own and who you would like to have it. Third, look at the list in paragraph nine to decide if you need to call a professional. Fourth, whether you do it yourself or with a pro, complete the basic documents: a will, a power of attorney, and a healthcare directive. Fifth, and this is very important, tell your executor or a trusted child where to find your binder. A perfect plan is useless if no one can find it!

Remember, we have all lived long enough to realize that no one lives forever. A question that must logically proceed from that reality is: What will happen to the assets that I might have received during my lifetime? You now have the knowledge and the simple steps to answer that question with confidence and faith, not fear. Take that first small step today. May God grant you wisdom and peace as you undertake this important act of love and stewardship.

Sources:

Internal Revenue Service (IRS): Information regarding federal estate tax exemptions can be found on the official IRS website, specifically under "Frequently Asked Questions on Estate Taxes."

Nolo.com: A widely respected legal self-help resource that provides plain-English explanations of wills, trusts, probate, and other estate planning topics.

AARP (American Association of Retired Persons): Offers numerous articles and resources on estate planning tailored for senior citizens, including checklists and guides on powers of attorney and healthcare directives.

The Holy Bible, English Standard Version: For scriptural references and perspective.

Please share your thoughts and any response you may have in the form below.

Return to SeniorHealthyLifestyles.com

Nursing Home

Abuse & Neglect https://olsonlawfirm.com/nursing-home-abuse-neglect/